Image via Wikipedia

Image via Wikipedia

Jeremy Siegel on 2010: Good for Stocks, Bad for Bonds -- and Why Interest Rates Will Go Up - Knowledge@Wharton

Knowledge@Wharton: What is inflation going to do?

Siegel: Inflation is going to be under control this year and probably into 2011. However, we will have an upward tilt to inflation, which means the longer-run trends point to a 2%-to-4% range of inflation rather than zero to two, which unofficially is what most central banks and the Fed have targeted.

The scaremongers, who worry that the ton of money the Fed created to fight off the crisis is going to fuel the next [period of] inflation, are wrong.

Knowledge@Wharton: But the 2%-to-4% range is standard over the long run, right?

Siegel: It's not. I remember when I was studying economics, we talked about what a victory it would be if we could get down to between 2% and 4%. We've been spoiled with very low rates. Most central banks use zero to two. They come closer to two.

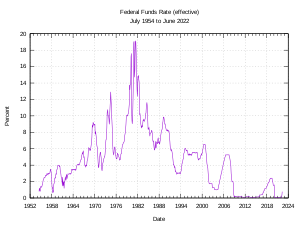

We'll move closer to between 2% and 4%, particularly in the United States, given the large deficits that we have and the liquidity that was created. But just as Bernanke acted very responsibly in providing the liquidity necessary to prevent [a repeat of] the Great Depression, he is also an excellent enough economist to know that money is what fuels inflation. The Fed is really solely responsible for inflation. He will not let it go above five, and probably not even four. He will raise interest rates to whatever level is necessary if inflation starts running into the mid-single digits or higher.

Knowledge@Wharton: When we talk about inflation, we also often talk about commodities. There has been a pretty good run in some commodities, especially gold. What do you see happening there?

Siegel: The commodities cycle has followed the world economy. It had hit its low very close to the same time the stock market did. Now that the world markets have recovered, we see oil has recovered. I would love to see it in the 70-to-80 range.

Commodities are fully priced. Gold ... is priced for an inflationary scenario that is much worse than will be realized. Gold is a risky investment now.... That is not going to be a good investment throughout 2010 and the longer term.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6497332c-8885-4ea5-afe0-cf13ad2fe87f)

No comments:

Post a Comment